Each merchant — e.g., a retailer, business or any other place where you can make a purchase — is assigned a code that indicates the merchant's primary area of business. When you make a purchase at a merchant, we're provided the code for that merchant and if the code matches a category that gives you additional miles, you will earn the additional miles. Because we don't control what code a merchant is assigned, sometimes a purchase that you think fits a certain category may not earn additional miles. Popular reserves the right to determine which purchases qualify for this offer. Earn 1 AAdvantage® mile for every $1 spent on all other purchases.

Miles may be earned on purchases made by primary credit cardmembers and Authorized User. Miles earned will be posted to the primary credit cardmember's AAdvantage® account in 8-10 weeks. There is no limit to the number of AAdvantage® miles you can earn on purchases through the use of the Popular / AAdvantage Signature Plus as long as the program continues, and your account remains open and in good standing. With the exception of special account status or circumstances (e.g. Military relief programs), the anniversary month will coincide with the month in which the annual fee is billed.

To receive the Flight Discount, your account must be open for one full billing cycle after your anniversary month. For your first year of credit cardmembership, purchases qualify as of the date of your account opening. The Flight Discount expires one year from date of issue of the certificate.

The Flight Discount is also redeemable for air travel on any oneworld® carrier or American Airlines codeshare flight. The Flight Discount is redeemable online at AA.com, or by calling American Airlines Reservations. A reservations services fee may apply for travel booked through American Airlines Reservations.

The Flight Discount is redeemable only toward the purchase of the base airfare and directly associated taxes, fees and charges that are collected as part of the fare calculation for travel. The Flight Discount cannot be used to pay the taxes and charges on mileage redemption tickets where only taxes and fees are being collected. The Flight Discount may not be used for flight products and/or services that are sold separately or non-flight products and/or services sold by American Airlines. If the ticket price is greater than the value of the Flight Discount, the difference must be paid only with a credit, debit or charge card, or with American Airlines Gift Cards.

Any unused balance can be applied towards eligible future travel until the stated expiration date. If travel booked with the Flight Discount is cancelled or changed by the credit cardmember, the Flight Discount will be forfeited and the credit cardmember will be responsible for any applicable fare difference and the applicable change fee. The Flight Discount is non-refundable, may not be sold and has no cash redemption value. After qualification, please allow 8-12 weeks for delivery of the Flight Discount. Whether you're a frequent flyer, business traveler or first–time passenger, Citi offers a variety of airline rewards credit cards to meet your travel needs. From preferred boarding to no foreign transaction fees, choose the travel credit card that fits your itinerary.

Plus, earn American Airlines AAdvantage® bonus miles with each of these Citi® / AAdvantage® credit card offers. To receive the Flight Discount, your account must be open for one billing cycle after your annual fee is billed. The Flight Discount is redeemable online at aa.com, or by calling American Airlines Reservations. American Airlines AAdvantage® bonus miles typically will appear as a bonus in your AAdvantage® account 8-10 weeks after you have met the purchase requirements. Miles may be earned on purchases made by primary credit cardmembers and authorized users. Miles earned will be posted to the primary credit cardmember's AAdvantage® account.

All flights on the itinerary must be domestic flights marketed by American Airlines and operated by American Airlines or American Eagle. This benefit will not be available for travel on codeshare flights booked with an American Airlines flight number but operated by another airline. For the Citi® / AAdvantage® credit card, up to four companions traveling with the eligible primary credit cardmember will also get their first checked bag free of charge if they are listed in the same reservation.

This benefit cannot be combined with any existing AAdvantage® elite program benefits, or with First or Business class benefits, including any waiver of baggage charges. Please see aa.com/baggage » for baggage weight and size restrictions. Applicable terms and conditions are subject to change without notice.

Purchases must post to your account during the promotional period. Many merchants will wait for a purchase to ship before they post the purchase to your account. I like to think of airline credit cards as offering "elite-lite" perks, such as priority boarding and lounge access, similar to the benefits you might receive if you have elite status. If you frequently travel with American but don't fly enough (or don't spend enough) to earn AAdvantage elite status, these credit card perks become even more valuable. Of course, a couple of the cards can also help you earn elite status faster via bonuses you get for spending certain amounts on the cards each year.

There is no limit to the number of AAdvantage® miles you can earn on purchases through the use of the Popular / AAdvantage® Signature Plus as long as the program continues, and your account remains open and in good standing. Citi® reserves the right to determine which purchases qualify for this offer. Miles may be earned on purchases made by primary credit cardmembers and authorized user. Miles earned will be posted to the primary credit cardmember's AAdvantage® account in 8-10 weeks. Every time you swipe your Citi AAdvantage Platinum Select World Elite Mastercard you'll earn miles. Eligible American Airlines purchases, along with purchases at restaurants and gas stations will earn you two miles per dollar.

If you spend $2,500 on purchases in your first three months as an accountholder, you'll earn 50,000 bonus miles. There, you can redeem for flights on American Airlines, American Eagle and other airline partners in the oneworld alliance. This card is often promoted, but there can be better signup offers online that are worth considering. There are also benefits that are akin to having elite status, such as preferred boarding for you and up to four companions and waived check bag fees.

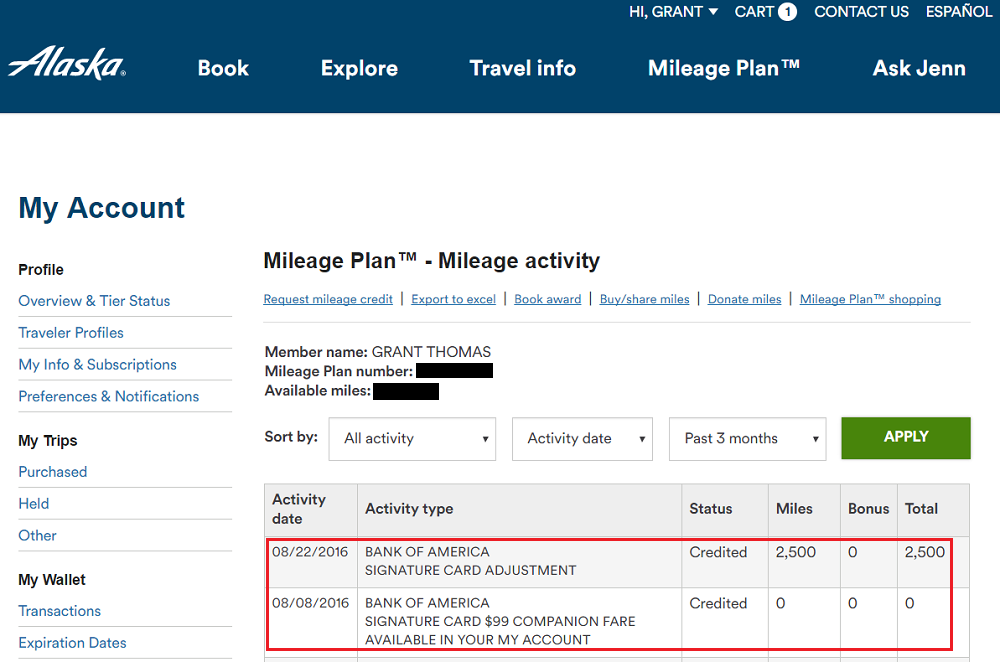

Even if you travel a few times a year, this can cover the annual fee cost easily. If you spend at least $20,000 on the card and your account remains open for at least 45 days after your card anniversary date, you'll earn a Companion Certificate good for 1 guest at $99 . If you don't spend enough to earn the 50,000 bonus miles and you don't travel frequently on American Airlines, you won't be able to make the most of this card. The $99 annual fee that kicks in after the first 12 months is only worth it if you're getting enough value out of flights purchased with miles, free checked bags and intangible benefits like preferred boarding. Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® credit card.

Savings do not apply to any other inflight purchases, such as wireless internet access. This benefit is not available on codeshare flights booked with an American Airlines flight number but operated by another airline. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel.

If your credit card account is closed for any reason, this benefit will be cancelled. Up to four companions traveling with and listed in the same reservation as the Citi® / AAdvantage® primary credit cardmember are eligible to board at the same time as the primary credit cardmember. For benefit to apply, the Citi® / AAdvantage® account must be open 7 days prior to air travel, and reservation must include the primary credit cardmember's American Airlines AAdvantage® number 7 days prior to air travel. Citibank offers several credit cards tied to American Airlines' AAdvantage program.

The next step up, the American Airlines Platinum Select World Elite Mastercard, carries an annual fee but includes a number of perks that are valuable to frequent American Airlines flyers, especially those without frequent flyer status. If you fly American Airlines frequently, prefer to check luggage or are attracted by the prospect of earning a more lucrative welcome bonus, this card is worth a look. The Citi AAdvantage Executive Card charges a considerable $450 a year in annual fees. There are also ample opportunities to earn AAdvantage miles and no foreign transaction fees to worry about. Travelers who are not AA-loyal, however, may opt instead for the Chase Sapphire Reserve Card, which has a more flexible set of benefits for the same price. This card is a solid option for frequent American fliers is that it earns two miles per dollar spent on AA flights.

It only earns one mile per dollar spent on everything else though. This is the kind of card to use when buying flights, but not when spending on other things since the mileage earning is weak on non-flight purchases. If you do plan to use the card for everything, note that there are no foreign transaction fees if using the card overseas.

New cardholders can earn 50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening. The American Airlines AAdvantage MileUp℠ Card is another good option for those that don't fly a lot but spend in other categories. It does not have an annual fee and offers double miles at grocery stores and American Airlines purchases. It even has a signup bonus of 10,000 miles and a $50 statement credit for spending $500 within the first three months. This deal makes this card one of the best credit cards for American Airlines fliers.

The Citi® / AAdvantage® Executive World Elite Mastercard® is ideal for anyone who wants complimentary access to Admirals Club airport lounges. While this card does have a $450 annual fee, the fact a new Admirals Club membership starts at $650 makes this card an exceptional value. You'll start off with a generous bonus of 50,000 miles when you meet the minimum spending requirement of $5,000 within three months of account opening, and you can also earn miles for each dollar you spend on your card. Terms apply.$695 (see rates & fees)5 points per dollar spent on airfare booked through Amex or directly with the airlines on up to $500,000 per calendar year and on prepaid hotels booked directly with Amex, 1x elsewhere.

The Amex Platinum is unmatched when it comes to travel perks and benefits. If lounge access, hotel elite status and annual statement credits are important to you, this card is well worth the high annual fee. The Chase Sapphire Preferred® Card is one of the most popular travel rewards credit card on the market.

Sporting an all-time-high sign-up bonus and offering an excellent return on travel and dining purchases, the card packs a ton of value that easily offsets its $95 annual fee. Cardholders can redeem points at 1.25 cents each for travel booked through Chase or transfer points to one of Chase's 13 valuable airline and hotel partners. If you're an American Airlines frequent flyer, you should take a look at the airline's array of co-branded credit cards. Signing up for the right American Airlines card could get you valuable airline perks, such as preferred boarding status, free checked luggage, lounge access and a faster track to elite status with the airline.

You're responsible for all charges made or allowed to the credit card account by the Authorized User. Miles earned on an Authorized User's credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the Authorized User. Authorized Users have access to your credit card account information. Before adding an Authorized User, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the Authorized User's name.

If we ask for information about the Authorized User, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized Users do not receive the first checked bag free or boarding benefits. Products or services that do not qualify are car rentals and hotel reservations (except taxes and charges paid when redeeming miles for car/hotel), purchase of elite status boost or renewal, and AA Cargo℠ products and services. You're responsible for all charges made or allowed to the credit card account by the authorized user. Miles earned on an authorized user's credit card will be allocated to the AAdvantage® account of the primary credit cardholder and not the authorized user.

Authorized users have access to your credit card account information. Before adding an authorized user, you must let him/her know that we may report credit card account performance to the credit reporting agencies in the authorized user's name. If we ask for information about the authorized user, you must obtain their permission to share their information with us and for us to share it as allowed by applicable law. Authorized users do not receive the first checked bag free or boarding benefits.

Citi® / AAdvantage® credit cardmembers will receive a 25% savings on inflight purchases of food and beverages on flights operated by American Airlines when purchased with their Citi® / AAdvantage® card. Savings will appear as a statement credit 8-10 weeks after the transaction is posted to the credit cardmember's card account. With no foreign transaction fees, it's a good card to use abroad as well. The $95 annual fee is waived the first year, making it a guilt-free way to get into the points and miles game. The frequent flyer miles earned as a result of purchases made on American Airlines credit cards are bonus/redeemable miles and do not count toward attaining elite status. However, the Citi AAdvantage Executive World Elite MasterCard and the Barclays Silver Aviator MasterCard each offer the ability to earn a limited amount of elite status miles when specific spending thresholds are met.

The sign-up bonus offers fluctuate, but your bonus miles will be awarded after you reach a spending threshold in the first 3 months after card approval. You'll earn 2 miles per dollar spent with American Airlines and 1 mile per dollar on all other purchases when using the AAdvantage Platinum card. The card waives foreign transaction fees and earns 2x miles on American Airlines purchases and 1x on everything else.

Day-of-travel benefits include preferred boarding and a free checked bag for the cardholder and up to four companions on the same domestic American Airlines reservation. If you spend more than $20,000 on purchases per account year, you will also receive a $99 companion certificate good for a round-trip domestic economy ticket. If you're not heavily committed to American, then, you might instead consider a card such as the Capital One Venture card. Like the Citi/AAdvantage Platinum Select World Elite Mastercard, the Capital One Venture has a $95 annual fee, but it isn't waived the first year.

All purchases with the Capital One Venture earn 2 miles per dollar spent. Those miles can be converted to those of other OneWorld airline programs, such as Qantas or used for other travel purchases such as hotels. The Citi AAdvantage Platinum Select World Elite Mastercard earns you 2x miles for every $1 spent at gas stations, restaurants, and when you make an eligible purchase with American Airlines and 1 mile per dollar on all other purchases. Also, if you spend $2,500 in your first three months you'll earn 50,000 bonus miles. You'll also get a waiver of the Elite Qualifying Dollar requirement for elite status when you spend at least $30,000 on your card.

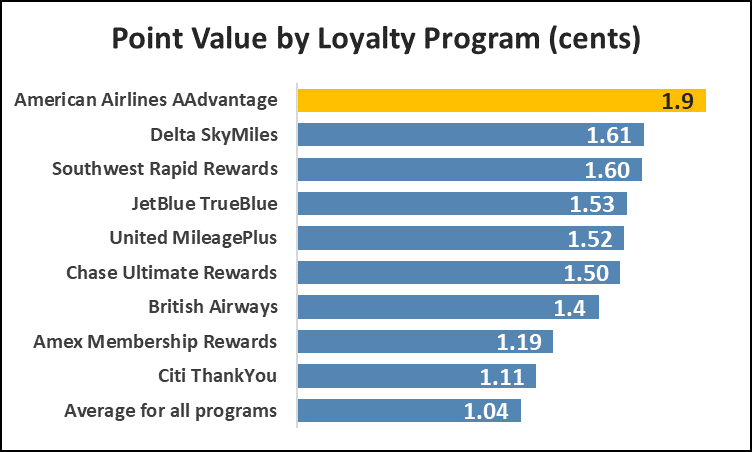

If you prefer a premium credit card, you could consider the Chase Sapphire Reserve instead. The card has a $550 annual fee, but up to $300 in annual travel credits help offset that cost. How to earn, redeem, and maximize American Airlines AAdvantage miles — even if you don't fly the airline Between its two issuer partners, Citi and Barclays, American Airlines offers an array of co-branded credit cards. They range from a no-annual-fee option to a $450-per-year premium credit card that includes access to the airline's Admirals Club airport lounges and rewards high spenders with elite-qualifying miles. After earning your 50,000 miles bonus, this card offers the best miles-earning potential, with bonus miles on gas station and restaurant purchases. Earn 2 AAdvantage® miles for every $1 spent at gas stations, restaurants, and on eligible American Airlines purchases.

The world's largest airline, American Airlines, offers a number of different credit cards from various banks. Airline credit cards such as these can be a great way to quickly earn frequent flier miles — and to redeem points on free travel. As with a frequent flyer program, travelers see the most benefits if they consistently fly with a single airline or alliance. This card brings lounge access no matter what airline you are flying.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.