With one of the industry's longest intro APR offers on qualifying balance transfers and purchases, the BankAmericard® credit card can be a useful money management tool. This card doesn't provide much in the way of other features beyond free FICO Score access and no penalty APR but it does now offer a new intro bonus. You get a $100 statement credit online bonus after spending $1,000 in the first 90 days. Despite having no rewards program, this card is still a solid choice for getting a temporary break from interest charges.Read our full BankAmericard® credit card review. The card also offers a lengthy promotional APR (0% intro APR on purchases and balance transfers made in the first 60 days for 15 billing cycles, then 13.99% to 23.99% variable APR) and has no annual fee.

Award-Winning Credit Card Options – The new card joins the suite of award-winning credit cards from Bank of America including the Bank of America Customized Cash Rewards credit card, which offers clients 3% cash back in a category of their choice. Cardholders choose from one of six categories including gas, online shopping, dining, travel, drug stores and home improvement. Customized Cash Rewards cardholders also earn 2% cash back at grocery stores and wholesale clubs, and unlimited 1% cash back on all other purchases.

Clients earn 3% and 2% cash back on the first $2,500 in combined purchases each quarter in the choice category, and at grocery stores and wholesale clubs, then earn unlimited 1% thereafter. For a $95 annual fee, the Premium Rewards card offers very generous benefits and helpful perks, especially for existing Bank of America customers, who could qualify for a rewards boost, depending on how much money they have in a Bank of America account. As its name suggests, this card offers lucrative rewards such as unlimited 2X points on travel and dining purchases, 2X points on grocery store purchases (now through Dec. 31, 2021), as well as 1.5X points on all other purchases. This card may appeal to occasional travelers who want a no annual fee credit card with a simple rewards system. Certain credit cards are eligible to receive the Preferred Rewards bonus.

Enrolled Preferred Rewards members can receive a Preferred Rewards bonus of 25% for the Gold tier, 50% for the Platinum tier, or 75% for the Platinum Honors tier based on their Program tier and type of card. If your product receives the 10% customer bonus, the Preferred Rewards bonus will replace the 10% customer bonus. The Preferred Rewards bonus for eligible cash rewards credit cards will be applied after all base and bonus cash rewards have been calculated on a purchase. For example, a $100 purchase that earns 3% ($3.00) will actually earn $3.75, $4.50 or $5.25 based on your tier when the purchase posts to your account.

For all other eligible card types, a purchase that earns 100 base points will actually earn 125, 150 or 175 points based on your tier when the purchase posts to your account. The Preferred Rewards bonus is not applied to any account opening bonus, if applicable. The Preferred Rewards bonus also does not apply to the bonus earn for certain programs. This information can be found in the Program Rules associated with those credit cards.

Please refer to your card's Program Rules for details about how you will receive the Preferred Rewards bonus. Program Rules are mailed upon account opening and are accessible through the rewards redemption site via Online Banking or by calling the number on the back of your card. Bank of America Premium Rewards credit card is our top pick for the best overall credit card and the best travel credit card due to its flexible redemption options, generous bonus offer, and no foreign transaction fees. While it does come with a $95 annual fee, the rewards and benefits you get from this card can more than make up for the cost. Bank of America offers a variety of credit cards with different rewards and benefits programs to meet the specific wants and needs of consumers. Whether you are looking for a personal credit that offers travel rewards, a student credit card to help you begin building credit, or a business credit card, Bank of America has a credit card that can fit your needs.

No matter your budget, Bank of America has a card for you with many cards that don't require an annual fee. Our winner for the best Bank of America student credit card is the Bank of America Customized Cash Rewards for Students because of its flexible cash back rewards program. This is a good card for students who want to build their credit while earning cash back on everyday items like gas, online shopping, and groceries. With no annual fee and a 12-month offer of 0% APR on purchases and balance transfers, it's worth checking out. Bank of America Premium Rewards card is our choice for the best overall and best travel card from Bank of America due to its flexible redemption options, generous bonus points offer, and no foreign transaction fees.

This card does charge a $95 annual fee, though that is in line with other popular travel rewards cards from competing issuers and should be easily justified with earnings from consistent use. This is a cash-back credit card that charges no annual fee, so don't expect any premium benefits like lounge access or travel credits. The card's main asset is its rewards structure, which we'll dig into later. Otherwise, the card offers standard credit card protections and benefits, including account alerts, a way to check your FICO score for free and fraud protection. We love credit cards, but we don't love how confusing they can be when it comes to earning or redeeming their rewards.

The Bank of America Travel Rewards credit card simplifies the travel rewards space with unlimited 1.5 points per $1 spent on all purchases. While this isn't the highest earning rate on a flat-rate rewards credit card, it can be significantly boosted for those who are members of Bank of America's Preferred Rewards program. We selected the Bank of America Customized Cash Rewards card as the best cash back rewards option from Bank of America because of its lucrative cash back rate on purchases and simple statement credit, check, or gift card redemption options. The card offers bonus earnings on a category of choice as well as enhanced earnings on grocery purchases, with a base rate on all other purchases.

A good credit card should offer benefits that are easy to use and a rewards system that works best for you. For instance, frequent travelers will find the most value with a travel-focused rewards card that offers perks such as travel statement credits, lounge access and trip insurance. Parents and other everyday shoppers might like the simplicity of a flat-rate cash back card with features like extended warranty and purchase protection. By holding a certain level of assets at BofA and setting up cash back auto-redemption to deposit into one of my BofA accounts I get a "rewards bonus" of 25-75%.

They also have "BankAmeriDeals" with various companies to further multiply your earnings - I get an extra 5-10% back when the deals are active at companies like Starbucks, PetSmart, etc. I will even see an item in store and buy online to get the extra points on larger purchases when my 3% reward is set to online shopping. In 2021 , I have earned $214.21 in cash back and received $95.98 bonus cash - $310.19 total deposited in my checking account. If you already have assets at BofA and/or do a lot of spending in one of their 3% categories I definitely recommend this card. I also find the BofA app easy to use, appreciate the security features on the card, and have always experienced excellent customer care. If you're looking for valuable travel rewards with no annual fee, your credit card options can be slim.

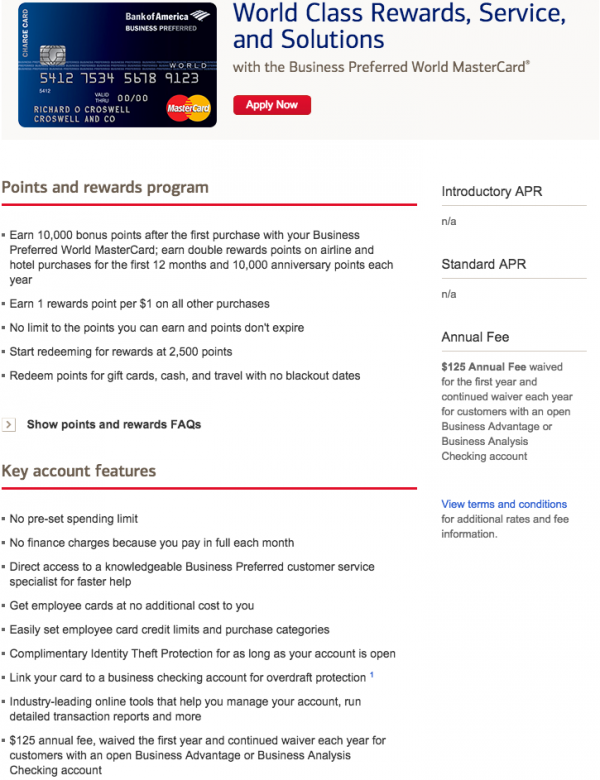

This card is one of the few that fit those criteria, and it also offers a boosted rewards rate on general purchases. Frequent business travelers will love using their rewards to cover even more travel with the Bank of America Business Advantage Travel Rewards World Mastercard credit card. However, the caveat to this flexibility is that there is a $2,500 combined purchase limit on the 2% and 3% categories each quarter. We rate the Bank of America Travel Rewards card as the best no annual fee travel card because of its generous rewards on all purchases and excellent bonus opportunity. Its travel redemption options and its lack of annual fee or foreign transaction fees also helped it to earn this top spot. Here's an intriguing option for loyal Bank of America customers interested in adding a travel credit card to the relationship.

The Bank of America® Premium Rewards® credit card is great for travel and dining purchases, which earn you 2 points for every dollar spent. You also earn 1.5 points on all other eligible purchases, and you can enjoy travel benefits you won't find with other Bank of America cards.Read our full Bank of America Premium Rewards credit card review. The Bank of America® Customized Cash Rewards credit card is a great option for earning cash back in multiple purchase categories, including one that you get to choose. You can select from six potentially lucrative categories to help ensure that you'll earn plenty of cash back in areas where you spend the most. Flexibility, lack of annual fee and the ability to earn 25%-75% more rewards as a Preferred Rewards member make it a valuable all-around card.Read our full Bank of America Customized Cash Rewards credit card review.

Whether you have the Bank of America® Cash Rewards credit card or the Bank of America® Platinum Plus® Mastercard® Business card, you may have an urgent need to access and manage your money immediately. The Bank of America client assistance webpage encourages banking online at home or through the bank's mobile app. Here you can check your accounts, pay your bills and deposit checks. There are a number of ways to make a Bank of America credit card payment.

You can pay your credit card balance online through the bank's website or app, call the Bank of America credit card customer service hotline for help, mail in a check or money order or stop by a branch. Choose a method that makes sense for you, taking into account how long it will take to receive the payment and any costs involved, including stamps and online data fees. The qualifying balance is calculated based on your average daily balance for a three calendar month period. Refer to your Personal Schedule of Fees for details on accounts that qualify towards the combined balance calculation and receive program benefits. Eligibility to enroll is generally available three or more business days after the end of the calendar month in which you satisfy the requirements.

Benefits become effective within 30 days of your enrollment, or for new accounts within 30 days of account opening, unless we indicate otherwise. Certain benefits are also available without enrolling in Preferred Rewards if you satisfy balance and other requirements. For details on employee qualification requirements, please visit the Employee Financial Services intranet site. Bank Cash+™ Visa Signature® Card is another major competitor. You'll earn 5% cash back on the first $2,000 you spend on your choice of two categories each quarter, plus unlimited 2% cash back on your choice of grocery store, gas station or restaurant purchases.

The potential bonus categories aren't quite as broad as with the Bank of America Customized Cash Rewards card, but include a larger variety (such as streaming services and gyms/fitness memberships). If you aren't eligible for Bank of America Preferred Rewards, this could be a better option for you long-term. If you are carrying a high amount of credit card debt and need some additional time to pay it down without incurring high interest charges, the BankAmericard credit card can be an effective option.

It offers an introductory 0% APR for the first 18 billing cycles for purchases and balance transfers made within 60 days of opening an account. Just keep in mind that you'll have to pay a 3% fee on the balance you transfer (or $10, whichever is greater). The Chase Freedom Flex is a Forbes Advisor top pick both for cash back credit cards and no annual fee credit cards, and with good reason. It offers 5% cash back on up to $1,500 spent in quarterly rotating categories when activated and on travel booked through Chase Ultimate Rewards, 3% cash back at restaurants and drug stores and 1% cash back on all other eligible purchases.

Many will come out ahead with this rewards scheme compared to that of the Bank of America Travel Rewards card. To choose the best Bank of America credit cards, we filtered our list of nearly 300 credit cards. We looked at credit card features including rewards, bonus offers, interest rates, fees, and benefits. We also considered the security of the card and the level of customer service provided. A weighted algorithm was used to determine which cards would be included in our final list. Some credit cards, including the Bank of America Premium Rewards credit card, do have a $95 annual fee but are worth it for those who take advantage of the generous bonus offer and solid reward points program.

If some of your travel purchases are a little off the beaten path, the Bank of America® Travel Rewards credit card could be a real find. You can receive statement credits for a wide variety of expenses, including zoos, campgrounds, art galleries and aquariums. You get a range of general and card-specific features with Bank of America. General features include Tap & Pay for quick retail purchases, secure banking with SafePass, safe purchases with ShopSafe, powerful online account settings and mobile banking to do anything on the move. Any rewards credit card will give you points automatically when you make purchases, which you can use to spend on vouchers, branded items and many others.

Tracy Stewart is a personal finance writer specializing in credit card loyalty programs, travel benefits, and consumer protections. He previously covered travel rewards credit cards, budget travel, and aviation news at SmarterTravel Media. His money-saving tips have appeared in the Washington Post, the Wall Street Journal, Consumer Reports, MarketWatch, Vice, People, the Zoe Report and elsewhere. Those looking for a travel rewards card without an annual fee, the Capital One VentureOne card is another flat-rate earnings option. It offers 1.25 miles per dollar spent on purchases—not quite as much as is offered by the Bank of America Travel Rewards Card. The Bank of America Customized Cash Rewards credit card offers a modest $200 cash-back bonus after spending $1,000 on purchases within the first 90 days of account opening.

It's certainly not the most competitive bonus out there, but it's easy to earn and on par with other no-annual-fee credit card bonuses. With the Bank of America® Customized Cash Rewards credit card, redeem cash back into a checking or savings account – and even get up to 75% extra value for qualifying Preferred Rewards customers. You can even redeem rewards automatically to the account of your choice. Get a $300 statement credit when you make at least $3,000 in net purchases within 90 days of your account opening - with no annual fee and cash rewards don't expire. CloseGet a $300 statement credit when you make at least $3,000 in net purchases within 90 days of your account opening - with no annual fee and cash rewards don't expire.

Close25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases. CloseOur writers, editors and industry experts score credit cards based on a variety of factors including card features, bonus offers and independent research. Credit card issuers have no say or influence on how we rate cards. The score seen here reflects the card's primary category rating. For more information, you can read about how we rate our cards. Bank of America's take on travel rewards doesn't include the posh perks that some other credit cards offer.

That doesn't mean, however, that the card comes without any perks. Being a Visa Signature card, it offers a few travel perks to get excited about, like concierge services and access to the Visa Signature Hotel Collection. Regular redemption is as simple as requesting points be applied to travel purchases. The one-time bonus is valued at $300, which is excellent for a no annual fee business card. $200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening. NerdWallet's credit cards team selects the best cards in each category based on overall consumer value.

Factors in our evaluation include fees, promotional and ongoing APRs, and sign-up bonuses; for rewards cards, we consider earning and redemption rates, redemption options and redemption difficulty. A single card is eligible to be chosen in multiple categories. This credit card program is issued and administered by Bank of America, N.A. Deposit products and services are provided by Bank of America, N.A. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation.

Visa and Visa Signature are registered trademarks of Visa International Service Association, and are used by the issuer pursuant to license from Visa U.S.A. Inc. Museums on Us, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. In addition to credit cards, Bank of America offers financial products and services including mortgages, car loans, checking and savings accounts and investments through Merrill Lynch. It doesn't offer the typical "cash back on all eligible purchases" opportunities, but you can occasionally earn cash back at participating merchants through BankAmeriDeals. You can also earn a $100 statement credit online bonus when you spend $1,000 in the first 90 days. 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening - that can be a $250 statement credit toward travel purchases.

If you prefer a hands-off rewards strategy, it's hard to go wrong with a card that offers unlimited 1.5 percent cash back on all purchases. The cash back rate is pretty standard, but it offers reliable value without requiring a second thought from you. The welcome offer is equally straightforward and valuable, too.Read our full Bank of America® Unlimited Cash Rewards credit card review. If you are eligible to enroll in Bank of America Preferred Rewards, this card could earn even more cash back.

You'll need an eligible Bank of America personal checking account and a three-month average combined balance of $20,000 or more in a Bank of America account and/or Merrill investment accounts to enroll. There are three tiers you can fall into based on your three-month average account balance, and you earn a cash-back bonus of between 25%-75% depending on your tier. By clicking "See my odds" you agree to our Terms of Use and Privacy Policy. These terms allow CreditCards.com to use your consumer report information, including credit score, for internal business purposes, such as improving the website experience and to market other products and services to you. I understand that this is not an application for credit and that, if I wish to apply for a credit card with any participating credit card issuer, I will need to click through to complete and submit an application directly with that issuer.

Get 75% more cash back on every purchase, if you have a business checking account with Bank of America® and qualify for our highest Preferred Rewards for Business tier. That means you will earn 5.25% on your selected choice category, 3.5% on dining and unlimited 1.75% cash back on all other purchases. Redeem your cash back as a deposit into your Bank of America® checking or savings account, as a card statement credit or as a check mailed to you. The card program offers generous statement credits for travel perks and enhanced insurance coverage2 that can help make traveling more enjoyable. Merrill Lynch Canada Inc. is registered as an Approved Participant of the Bourse de Montreal. "Bank of America" and "BofA Securities" are the marketing names used by the Global Banking and Global Markets divisions of Bank of America Corporation.

BofA Securities, Inc. and Merrill Lynch Professional Clearing Corp. are registered as futures commission merchants with the CFTC and are members of the NFA. The Bank of America Travel Rewards card offers a welcome bonus that allows eligible new cardholders to earn 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening. Ben Woolsey is Investopedia's Associate Editorial Director of Financial Products and Services, including credit cards. He has more than 30 years of experience in the financial services industry, including marketing for banking and financial institutions such as Associates First Capital and Bank One. Prior to Investopedia, he managed credit card content for CreditCards.com and Bankrate.com.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.